Remain Upgraded with Market Trends on a Leading Forex Trading Forum

Checking Out the Influence of Money Exchange Rates on Your Investments

The influence of money exchange rates on investments is a nuanced subject that requires mindful factor to consider, particularly for those involving in worldwide markets. As capitalists browse these complexities, recognizing the interaction in between currency characteristics and possession worths ends up being critical.

Comprehending Currency Exchange Rates

The details of currency exchange rates play a crucial role in the international monetary landscape, affecting financial investment decisions throughout boundaries. Currency exchange rates stand for the worth of one money in connection with one more and are figured out by different aspects, including rate of interest, rising cost of living, political stability, and economic efficiency. Recognizing these rates is essential for financiers taken part in global markets, as variations can considerably impact the success of financial investments.

At its core, a currency exchange price can be classified as either taken care of or floating. Dealt with currency exchange rate are fixed to a steady money or a basket of money, providing predictability however restricting adaptability. On the other hand, drifting exchange prices fluctuate based on market forces, permitting more responsive changes to economic facts.

Furthermore, currency exchange rate activities can be influenced by speculative trading, in which financiers get or offer currencies in expectancy of future changes. Awareness of these dynamics enables capitalists to make educated choices, minimize risks, and maximize opportunities in the international exchange market. Inevitably, a comprehensive understanding of currency exchange rates is essential for navigating the intricacies of global investments properly.

Impacts on International Investments

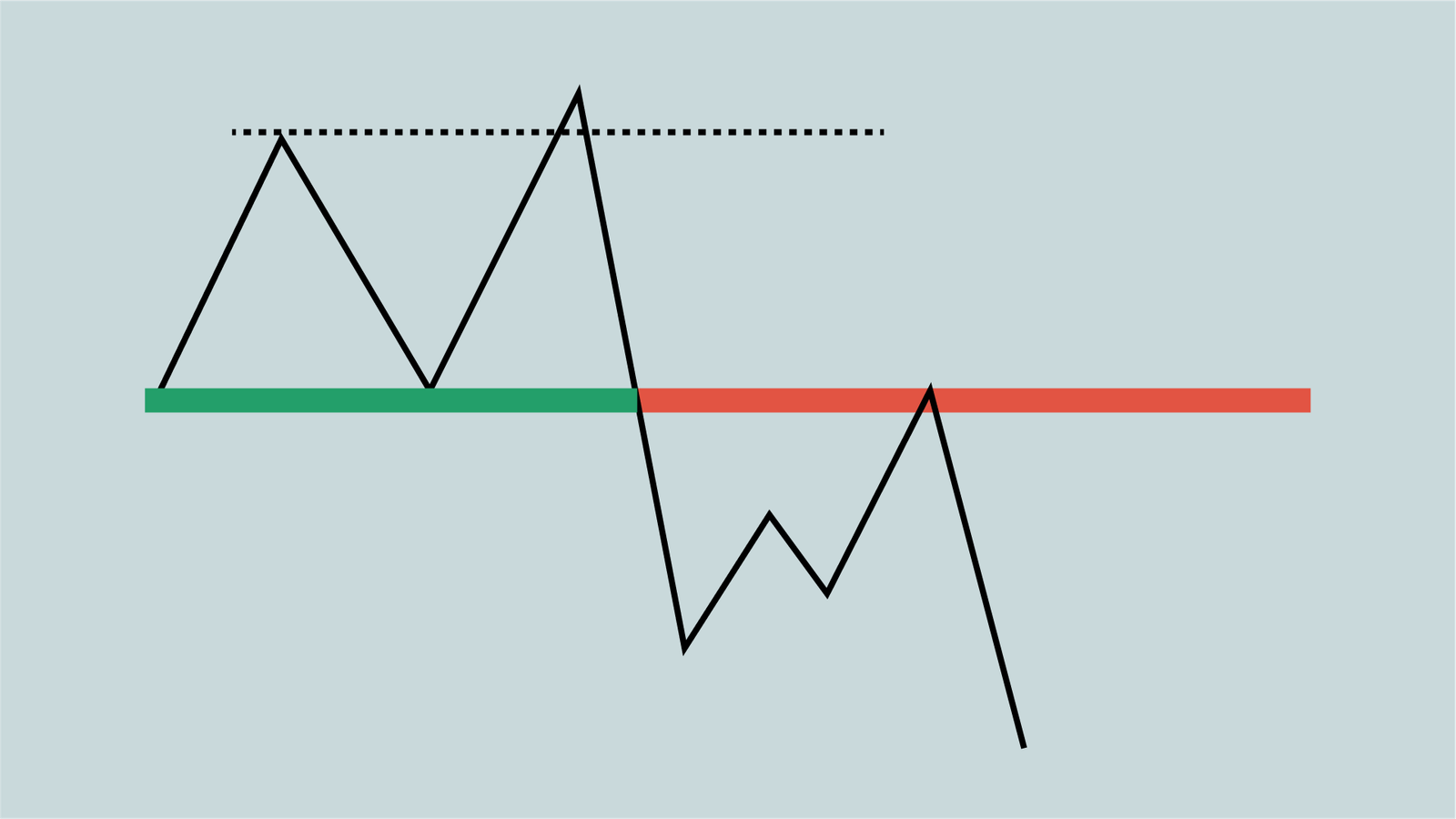

Variations in money exchange rates can significantly affect international investments, influencing both the returns and dangers connected with cross-border transactions. When an investor allocates capital to foreign markets, the worth of the investment can be impacted by changes in the currency pair between the financier's home currency and the international money. If the foreign money diminishes against the capitalist's home money, the returns on the investment might diminish, even if the underlying possession executes well.

In addition, money risk is an integral factor in international financial investments, necessitating a mindful evaluation of possible volatility. This danger can result in unexpected losses or gains, making complex the investment decision-making procedure. Capitalists may minimize this risk through various strategies, such as currency hedging or diversification throughout several currencies.

Moreover, exchange price fluctuations can also influence the beauty of international financial investments about residential alternatives - forex trading forum. A strong home currency may encourage residential financiers to look for opportunities abroad, while a weak home money may hinder investment in worldwide assets because of regarded higher prices. Inevitably, understanding these results is crucial for capitalists aiming to optimize their international profiles while taking care of currency-related risks successfully

Effect On Buying Power

Adjustments in money exchange prices can straight wear down or improve buying power, influencing consumers and financiers alike. When a money reinforces versus others, it increases the purchasing power of customers holding that money, enabling them to purchase more goods and services for the exact same quantity of money. Alternatively, a weakening currency reduces acquiring power, making foreign items much more pricey and potentially resulting in inflationary stress locally.

For capitalists, the ramifications of altering currencies prolong past immediate purchasing power. visit their website Investments in foreign markets can yield different returns when transformed back to the financier's home money. A strong home currency can raise the value of international financial investments upon repatriation, while a weak home money can lower returns significantly.

Moreover, variations in exchange prices can affect customer actions and investing patterns. A decline in buying power may trigger customers to prioritize important goods over deluxe things, thereby impacting the more comprehensive financial landscape. Comprehending the effect of currency exchange prices on acquiring power is vital for making informed monetary decisions, whether one is a consumer browsing day-to-day expenses or an investor assessing the stability of global possibilities.

Approaches for Money Danger Management

An additional method is diversity, which entails spreading out investments across numerous currencies and geographic areas. This lowers direct exposure to any solitary currency's volatility, consequently maintaining overall returns. Capitalists may additionally take into consideration purchasing currency-hedged funds, which are particularly made to reduce currency threat while still giving accessibility to foreign markets.

In addition, keeping a close watch on financial signs and geopolitical events can aid financiers make informed decisions regarding their money exposures. Applying a self-displined method to money risk administration with normal analyses and adjustments can better improve durability versus negative exchange price activities.

Case Researches and Real-World Instances

How do real-world circumstances show the complexities of money exchange rates on financial investment end results? The gains made in the supply market were balanced out by unfavorable exchange price motions, demonstrating exactly how money changes can significantly influence financial investment profitability.

One more illustratory instance involves a multinational firm earning income in numerous currencies. An U.S. firm with substantial procedures in Japan saw its earnings eroded when the yen deteriorated against the buck. This currency devaluation brought about a reduction in reported earnings, prompting the business to reassess its global revenue method.

These case studies highlight the need for investors to check money exchange patterns proactively. They highlight that while straight financial investment performance is essential, the interaction of currency exchange rate can dramatically alter general financial investment outcomes, necessitating an extensive technique to run the risk of monitoring.

Conclusion

To conclude, money exchange rates play a crucial role in forming investment outcomes, specifically in global markets. Variations in currency exchange rate can boost or wear down the worth of foreign assets, thereby influencing overall profile performance. A comprehensive understanding of these characteristics, combined with effective threat Continued management approaches such as hedging and diversity, is crucial for financiers looking for to optimize returns and mitigate prospective threats connected with currency movements. Awareness of these variables is vital for educated investment decision-making.